ROTH IRA CONVERSION — MADE EASY!

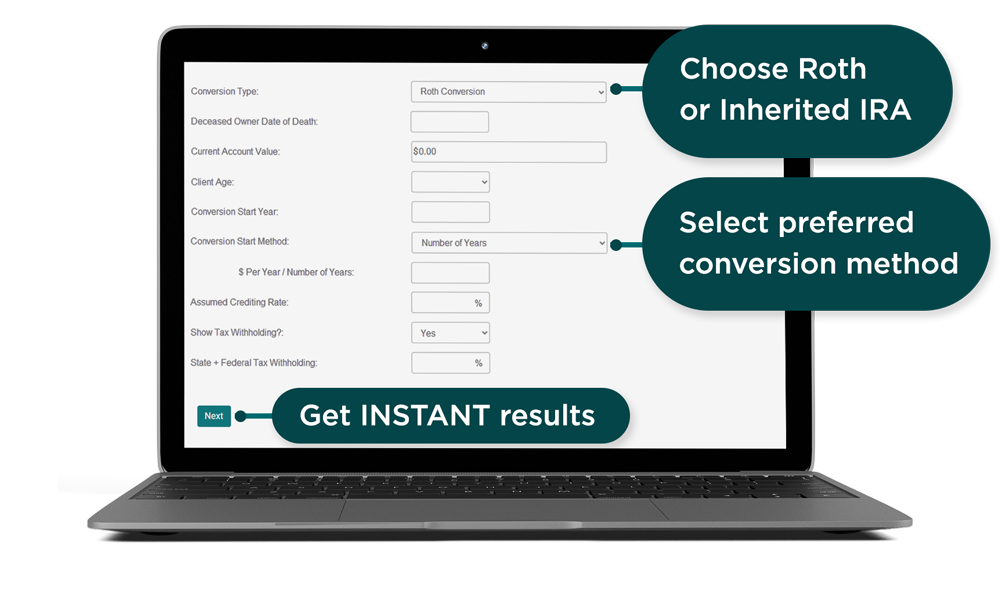

With EquiTrust’s Partial Tax Conversion (PTC) approach, Roth IRA conversions are flexible, turnkey and simple — with one mirrored contract.

Clients have the power to select when and how much to convert1

.png?width=80&name=files%20(1).png)

Original IRA is converted to the Roth IRA with one mirrored contract

We’ll withhold the taxes2

CLIENT APPROVED

Roth conversion customizable flyer

Share this flyer with clients to show how easy Roth conversion can be.

QUESTIONS?

Contact Sales Support at 866-598-3694 or Sales.Support@EquiTrust.com, or complete the form below.

1 The annuity owner determines the timetable for the conversion, selecting when and how much money to convert, subject to no more than one partial conversion per contract year.

2 Any amount withheld before age 59½ may result in a 10% IRS penalty tax.

EquiTrust does not offer investment advice to any individual and this information should not be construed as investment advice. Products underwritten, issued and distributed by EquiTrust Life Insurance Company, West Des Moines, Iowa.