WEALTHMAX BONUS

LIFE® SALES KIT

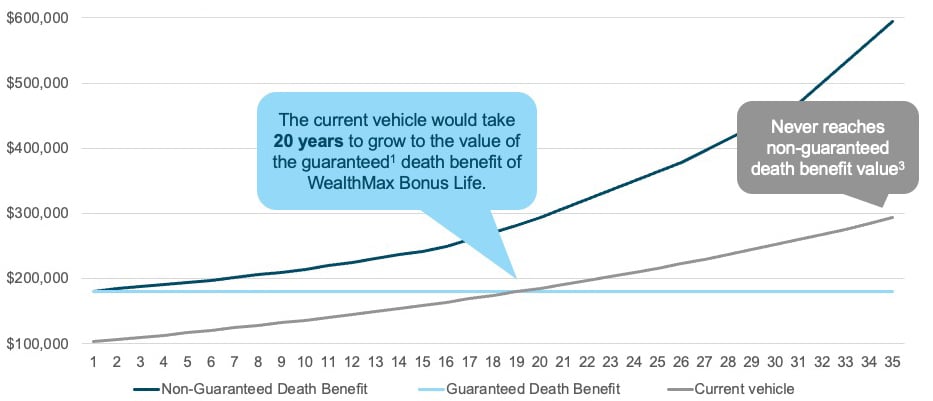

Compared to taxable wealth transfer vehicles, WealthMax Bonus Life shines — offering living benefits, growth potential, powerful guarantees1, simplified underwriting and more!

60%

of benefactors plan to use life insurance for wealth transfer

Only 17%

say their financial professional has recommended it as a solution

The policy’s Accelerated Death Benefit Rider4 allows clients to access policy benefits during their lifetime to help cover qualifying expenses related to chronic care, nursing home confinement or terminal illness.

For a 65-year-old woman with $50,000 premium, benefits through the Accelerated Death Benefit Rider would be available for these amounts in the event of one of the following health-related conditions.5

WealthMax Bonus Life includes a no-charge Longevity Benefit, which may be used to convert the death benefit into an income stream if certain conditions are met.

Meet Carol – female, Non-tobacco, issue age 65, initial premium: $100,000

Payments available for election at the end of policy year 20 and age 856

$237,919

Accumulation Value/Cash Surrender Value

$278,842

Longevity Benefit

$4,647 per month for 60 months

Questions?

Contact Sales Support at 866-598-3694 or Sales.Support@EquiTrust.com, or complete the form below.1 Guarantees based on the claims-paying ability of EquiTrust Life Insurance Company.

2 Generational Wealth Transfer, LIMRA, March 2025.

3 This example is hypothetical and for illustrative purposes only. Assumptions: Female, age 65, standard non-tobacco rating class with a $100,000 single premium. Taxes are paid from taxable vehicle, All other interest is reallocated. This hypothetical chart compares a potential death benefit that may be payable to a beneficiary of a life insurance contract with a taxable vehicle.

4 Accelerated Death Benefits may vary by state, including waiting periods after issue date, exclusion of Nursing Care Confinement or Chronic Care benefits, administrative fees, definitions of illness, or discount factors. Refer to the Accelerated Death Benefit Rider Disclosure included with the application for rider provisions in your state. Accelerated Death Benefits may be payable in the event of either terminal illness or chronic illness, but not both. Accelerated Death Benefits may be income tax-free. You should consult a qualified tax professional for information on how benefits received may impact your personal situation. The Accelerated Death Benefit shown is based on the initial face amount. Rider provisions, availability and definitions may vary by state.

5 Example assumes a 65-year-old female, non-tobacco user. $50,000 single premium x 1.80 face-amount factor = $90,000 death benefit at issue.

6 Based on non-guaranteed illustrated death benefit at earliest possible election.

WealthMax Bonus Life policy issued on Policy Form Series ICC19-ETLIUL-2000(01-19) or ETL-IUL-2000(01-19). Riders issued on Form Series ICC11-ETL-ADBR(03-11); ICC17-ETL-FPW(01-17); ICC17-ETL-PBR(01-17); ETL-GWBR(12-23); and ICC19-ETL-MCSV(01-19). Products underwritten, issued and distributed by EquiTrust Life Insurance Company, West Des Moines, Iowa.

Get real-life numbers for a hypothetical case to share with your clients.